What are GP-led secondaries?

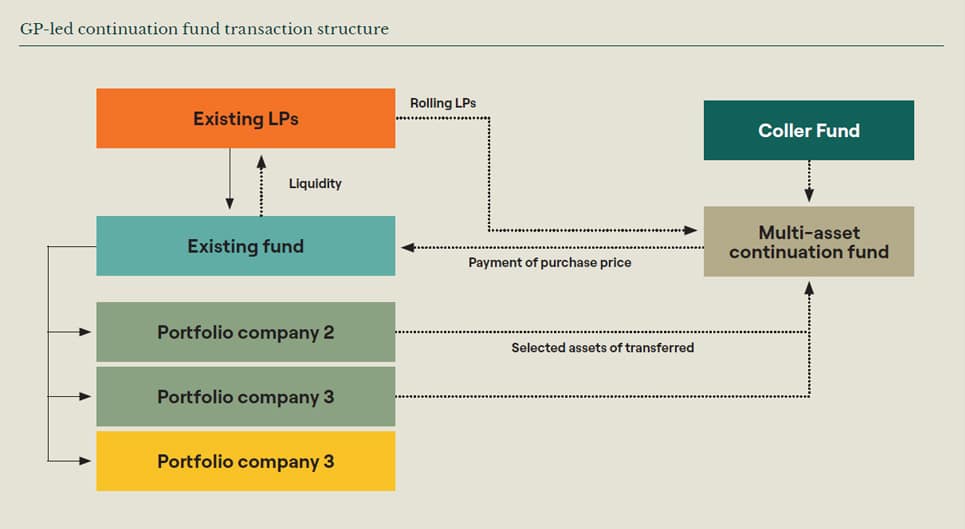

GP-led secondaries are transactions initiated by a General Partner and they are today an important segment of the private capital secondaries market. The most common form of GP-led is a continuation fund, which involves the sale of some or all of a fund’s existing assets to a new vehicle, which continues to be managed by the fund’s GP and is capitalised by the buyer(s) and the rolling LPs.

Usually, existing LPs can exit their position and take liquidity or ‘roll’ their existing interest into the new continuation fund. The buyer will normally negotiate a new economic and governance agreement, to ensure oversight of, and alignment with, the GP.

Motivations for LPs, GPs and secondaries buyers

- The GP continues to manage their assets, which often still have significant upside potential.

- The continuation fund can extend hold periods and unlock follow on capital for growth acceleration and optimal exits

- Fund economics can be redesigned to incentivise the GP managing the assets.

Buyers in the LP-led market

| Deeper diligence of the assets | Strong alignment with the GP |

|

|

GP-led market developments

GP-leds have increased in importance in the secondaries market and now represent around half of transaction volume. Since 2016 the size and quality of GP-leds have increased and a number of top-tier GPs have used this route as a liquidity solution.

Single-asset GP-leds have also grown in popularity. They can be attractive to buyers and GPs, sometimes providing assets with capital for growth and/or M&A. Both LPs and GPs are increasingly comfortable with GP-led secondaries and the strategy is now accepted as a tool for liquidity and fund management.