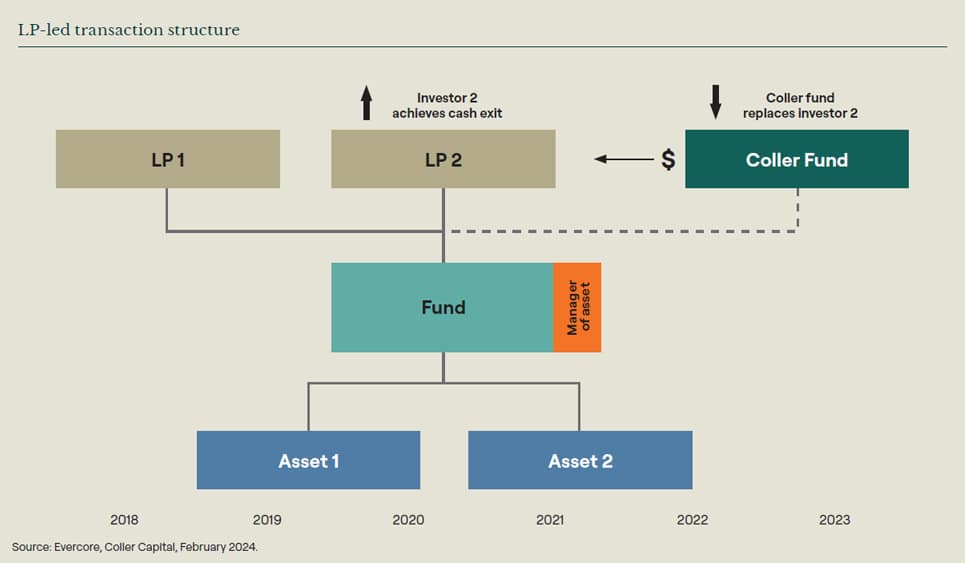

What are LP-led secondaries?

Limited Partner (LP) secondaries transactions occur when private capital investors sell interests in funds to other investors, typically secondaries funds. The purchasing investors become replacement LPs in the funds in question and assume the original investors’ obligations.

Motivations for sellers

- Strategic: Sometimes LPs want to sell fund positions as part of a broad reshaping of their private market portfolios.

- Tactical: As private markets have grown, LPs are increasingly taking a proactive approach to modifying their portfolios.

- Distressed: In volatile times, LPs might have a pressing need for liquidity and be forced to sell positions.

- Relationship change: Sometimes, LPs want to re-evaluate their GP relationships and desire to change exposure to specific managers, or refocus on their core partnerships.

Buyers in the LP-led market

| Single-buyer solutions | Mosaic solutions |

|

|

Market developments

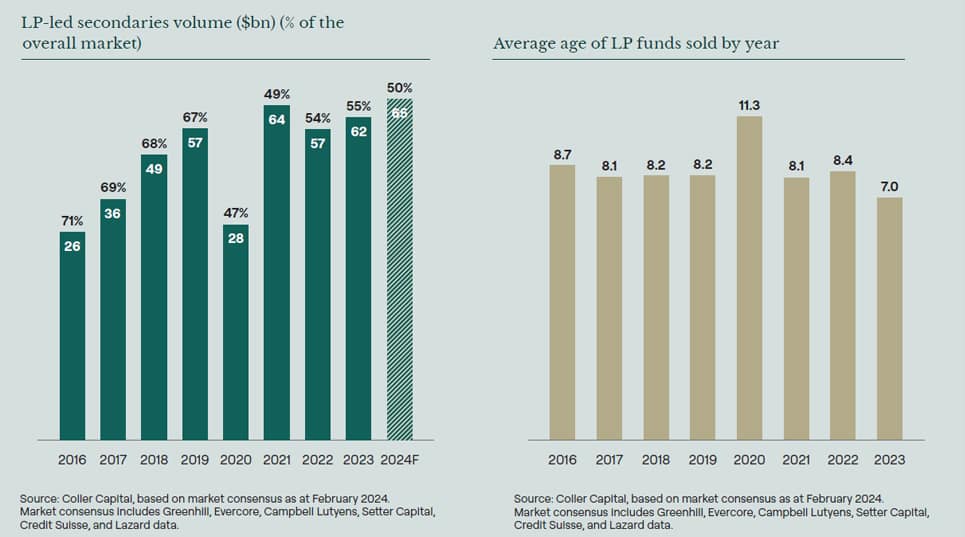

The secondary market was originally created to support the sale and purchase of limited partner interests in individual private market funds or portfolios of funds. Whilst the wider secondary market has evolved to encompass other transaction types, LP portfolio transactions continue to represent around half of annual transaction volume. In 2023, LP-led volume was $62bn, over half of the full year total. In 2024 the secondary market is expected to be slight more balances, with LP-led transactions estimated to constitute 50% of the market.

An interesting evolving dynamic in the LP-led market is the average age of fund interests sold, which in 2023 was seven years. This a decline from the usual range of eight to nine years, and significantly lower than 2020’s peak of 11.3 years. A number of factors could underpin this trend, e.g. some buyers may be looking for more upside potential from younger vintages.